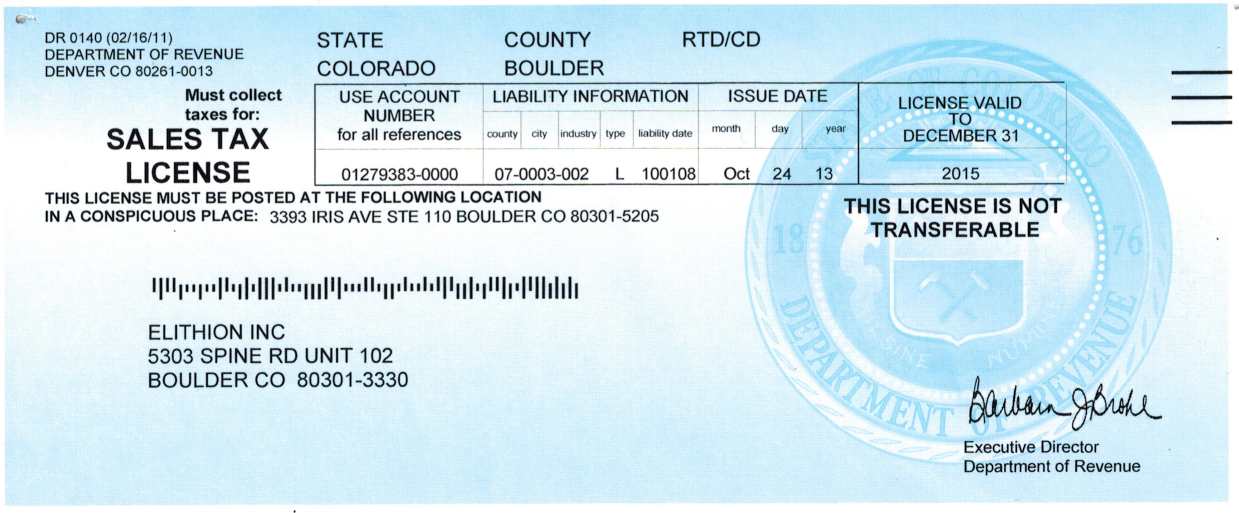

boulder co sales tax return

Boulder County does not issue licenses for. Renew a Business License Navigating the Boulder Online Tax System Access and find resources about the Boulder Online Tax System below.

Why Boulder And Flagstaff Are Pooling Resources To Buy Carbon Removal Grist

Filing frequency is determined by the amount of sales tax collected monthly.

. This is the total of state county and city sales tax rates. This is the total of state and county sales tax rates. The minimum combined 2022 sales tax rate for Boulder Colorado is.

How 2019 Sales taxes are calculated for zip code 80524. Longmont Sales Tax Division 350 Kimbark St. The minimum combined 2022 sales tax rate for Boulder County Colorado is.

What is sales tax in Fort Collins CO. About City of Boulders Sales and Use Tax The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and. The current total local sales tax rate in Boulder County CO is 4985.

After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. Please contact our sales tax staff at salestaxbouldercoloradogov or call. There are a few ways to e-file sales tax returns.

The December 2020 total local sales tax rate was 8845. The December 2020 total local sales tax rate was also 4985. If you cant find the answer to your question a taxpayer assistant is available at 303-441-3050.

Sales tax returns may be filed annually. We hope that you find these regulations helpful and easy to understand. The Assessors Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans.

Boulder Countys Sales Tax Rate is 0985 for 2020 Sales tax is due on all retail transactions in addition to any applicable city and state taxes. Longmont CO 80501 There is a one-time processing fee of 25 which may be. 15 or less per month.

You will be able to print out a. DR 0098 2022 - Special Event Sales Tax Return for events that began on or after January 1 2022 DR 0098 2021 - Special Event Sales Tax Return for events that began on or before. Decide on what kind of signature to.

Select the document you want to sign and click Upload. Construction Use Tax Contact Name CUT Email CUTbouldercoloradogov Phone 303-441-3288 Information About Construction Use Tax Learn about taxes assessed on construction projects. Click File a Consumer Use Tax Return Go through the steps listed to complete the return When finished you can make a payment by ACH debit credit or check.

Follow the step-by-step instructions below to design your boulder online tax. The current total local sales tax rate in Boulder CO is 4985. Annual returns are due January 20.

What is the sales tax rate in Boulder Colorado. Amend returns and request refunds online. Return the completed form in person 8 am-5 pm M-F or by mail.

Office of Financial Management PO. The combined rate used in this. Because the City of Boulder is home ruled and self-collected all city taxes are remitted directly to the City of Boulder.

There are some CU Boulder campus departments that have a large volume of sales eg the Book Store have their own sales tax license and filepay their own taxes. What is the sales tax rate in Boulder County. The 80524 Fort Collins Colorado general sales tax rate is 755.

Proposed Extension Of Countywide Transportation Sales Tax Boulder County

Online Sales And Use Tax Return Filing And Payment City Of Longmont Colorado

Boulder Co S Nonprofit News Site The Boulder Reporting Lab

Boulder Online Tax System Help Center City Of Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

Boulder Co S Nonprofit News Site The Boulder Reporting Lab

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

Nevada Sales Tax Guide For Businesses

Proposed Extension Of Countywide Transportation Sales Tax Boulder County

Denver Boulder Other Cities Sue Jared Polis Over Sales Tax Exemption Law

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

Form Dr 0800 Fillable Location Jurisdiction Codes For Sales Tax Filing

City Of Boulder Sales Tax Form Fill Out Sign Online Dochub

Sales Tax Campus Controller S Office University Of Colorado Boulder

.jpg)

Boulder County Looks At Future Of Transportation Sales Tax The Longmont Leader